Let me start this article with a confession: I am not a Wall Street prodigy. I am just a regular person who binge-watched Wolf of Wall Street during lockdown and thought, “How hard could trading be?” Continue reading, and I promise you values that are worth your time.

Table of Contents

I blew $1,000 in my first week of day trading meme stocks. But then I discovered swing trading, a slower, calmer approach that finally got me to $500/day. No, I’m not retired. Yes, I still panic sell sometimes. But after two years of trial and error, here is exactly how I made it work.

What Is Swing Trading and How Does it Work

It is very important to know that swing trading is not day trading. Imagine you are surfing on the sea, day traders ride waves for seconds while swing traders catch bigger waves for days or weeks. Here’s the difference:

Day Trading:

Day trading is stressful; they monitor the trades every time, which makes them glued to their screens. They can take 100+ trades/day.

Swing Trading:

Swing traders take fewer trades (3–5/week); they also practice (HODL) holding stocks or crypto for 1–10 days.

Why I Chose Swing Trading

1. I have a day job that I do (this blog doesn’t pay the bills yet).

2. I like my sleep. Nothing can deprive me of my sleep.

3. It is less emotional; no staring at charts during bathroom breaks.

Step by Step Guide to Making $500/Day With Swing Trading

Step 1: I started with $2,000 and not with a small amount like $100. Many people have been lied to on TikTok. The truth is you can not turn $100 into $10k overnight without insane risk. I saved $2k over six months, which makes my capital enough to absorb losses without crying.

Step 2: I Mastered 3 Price Patterns

Forget complicated strategies. These three patterns make up 80% of my wins:

1. The Pullback:

Many stocks like Tesla often surge, you can buy the dip (5–10%) and then rebound. Buy the dip, sell the rebound.

2. The Breakout:

When Bitcoin breaks past a resistance level (e.g., $30k), it often jumps 5–20% quickly.

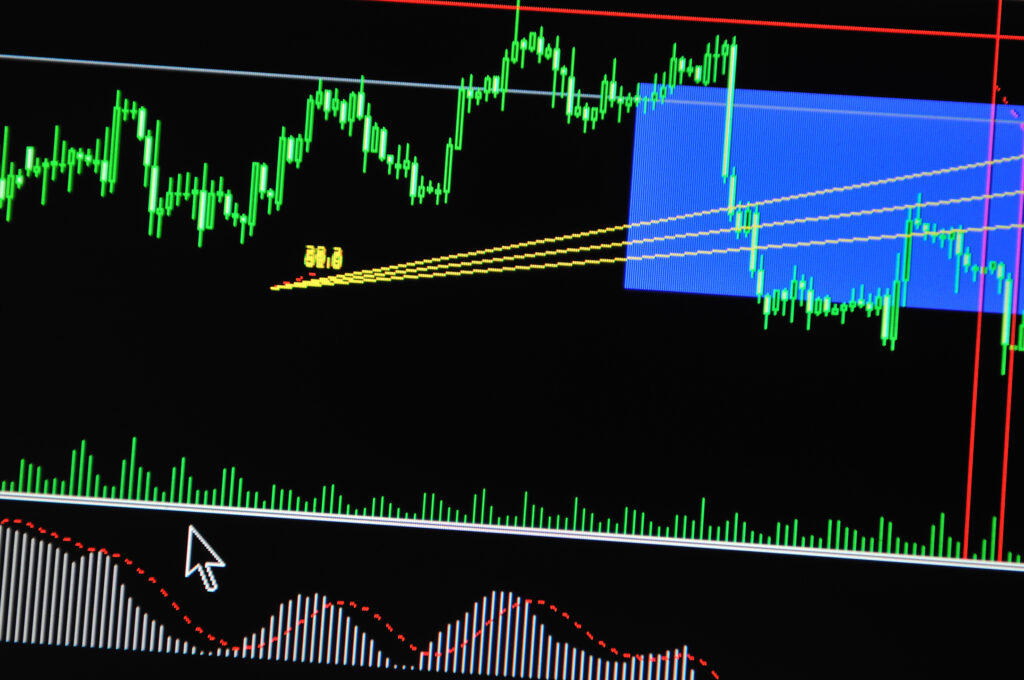

3. The EMA Crossover:

Use the 20-day and 50-day Exponential Moving Averages (EMA). When the 20-day crosses above the 50 day, it is a buy signal.

Step 3: I Used These Free Tools

– TradingView: TradingView has been my resource for viewing charts. The free version works fine.

– CoinGecko: This gives you the luxury of tracking crypto market sentiment.

– Finviz: Scanning stocks under $10 is made easy and possible through Finviz (my sweet spot).

Step 4: I Risked Only 1–2% Per Trade

– If I have $2k, I risk $20–$40 per trade.

– If a trade goes south, it would just be a loss of fancy coffee and not my rent.

Step 5: I Set Stupid Simple Rules

– Buy: Only between 9:30–11:30 AM EST. For me, stocks are more predictable early, I think.

– Sell: I always sell within 1–5 days with no exceptions.

– Stop-Loss: Automatic 5% below buy price.

Lessons From My 3 Biggest Wins

1. AMC Stock Mania (2021): Bought at $8, sold at $60 in 6 days. Lesson: Meme stocks can work if you exit fast.

2. Solana’s 2023 Rally: Bought SOL at $20, sold at $38 after 9 days. Lesson: Crypto trends last longer than you think.

3. Microsoft’s AI Boom (2023): Bought at $250, sold at $310 in 2 weeks. Lesson: Following the news to make informed decisions is golden.

However, I won’t be real if I don’t tell you about my losses. Out of all the losses, I discovered that these following things are the common mistakes that I could have avoided.

Common Mistakes That Can Ruin Your Trades

1. Chasing “Sure Things”: I lost $400 on a guaranteed Dogecoin pump that tanked based on a friend’s advice.

2. Ignoring Stop-Loss: I once held on to a crashing NFT stock hoping that it would recover. The trade did not recover.

3. Overtrading: I traded multiple times in a day because the market was bad and I could not decipher in time, so I made 12 trades in a day. Lost $300 to fees and bad decisions.

4. Trusting Twitter Gurus: There was a time I bought a so called secret strategy course. On checking through and implementing some strategy, I found out that It was garbage.

Essential Tools Every Swing Trader Needs.

– Free Trading Tools:

- CoinGecko’s portfolio tracker.

- Yahoo Finance’s earnings calendar.

- TradingView (basic plan).

– Paid Trading Tools:

- Benzinga Pro ($99/month for real-time news).

- TrendSpider ($47/month for automated chart alerts).

BONUS: My Daily Routine For Swing Trading (It’s Boring, But It Works)

6:00 AM: Scan the news for heads up (CoinDesk, Yahoo Finance).

7:00 AM: Check pre-market stocks and crypto on TradingView.

9:30 AM: After connecting some dots from the information I have, I place 1–2 trades based on my watchlist.

11:30 AM: STOP. No more trades until tomorrow.

Evening: Review trades, update journal, and relax.

Pro Tip: I avoid weekends. Markets are closed, and I’m not tempted to YOLO on crypto.

Check this out: “How I Avoided Crypto Scams“

Conclusion

You need to understand that swing trading is a marathon, not a sprint, and it is not as easy as it has been portrayed. You won’t see me flexing on Instagram about it. But here is the truth: consistency beats genius. If you are consistent, you would definitely make some figures out of it.

Make sure you start small. Stick to your rules, and for the love of God, turn off leverage.

Oh, and unfollow anyone who says, “This strategy works 100% of the time.” They’re lying, selling a course, or both.

FAQs

Is swing trading profitable for beginners?

Yes, but success depends on risk management , strategy and market conditions.

What is the best strategy for swing trading stocks?

Pullbacks, breakouts, and EMA crossovers are proven strategies for timing entries and exits.

How much money do I need to start swing trading?

$500-$2000 is a reasonable start, but risk should be limited to 1-2% per trade.

How do I find the best stocks for swing trading?

Use screeners like Finviz or TradingView to filter stocks with strong trends, volume, and volatility.