I usually do hear how people lost their house rent until October 2022, the day I lost a month’s rent in 3 hours. Bitcoin had just dipped below $20k, and I was so sure it would bounce back. I threw $3,000 into BTC futures with 10x leverage, envisioning a beach vacation already. Instead of that, I got a masterclass in humiliation.

By lunchtime of that fateful day, Bitcoin had dropped another 8%, and my position was liquidated. My heart sank; I wished the world could come to an end immediately when I received an email of liquidation. My rent money is gone just like that.

That was when I realised that risk management is not boring; it is an essential knowledge for survival. Today I will be writing about how you can safeguard your investments and avoid losing your rent, just as I did.

Table of Contents

What is Risk Management

Think of risk management like wearing a seatbelt in a car. You don’t wait until there is an accident before you start considering whether to use it or not. Neither are you expecting a crash, but you buckle up anyway. In finance, this means three things:

- Knowing what can go wrong (e.g., crypto crashes, job loss).

- Preparing for the worst (without becoming a doomsday prepper).

- Sticking to a plan (even when FOMO screams, “Buy that meme coin!”).

5 Risk Management Rules That Can Save Your Portfolio

1. The 1% Rule: Why I Risk Less Than a Netflix Subscription

Never risk more than 1% of your total portfolio on a single trade.

Why it works:

- If I have $10k, my max loss per trade is $100.

- Even 10 bad trades in a row only cost me $1k (ouch, but survivable).

My 2023 win: Lost 8 trades straight on AI stocks but still ended the month +12% overall because of this golden rule.

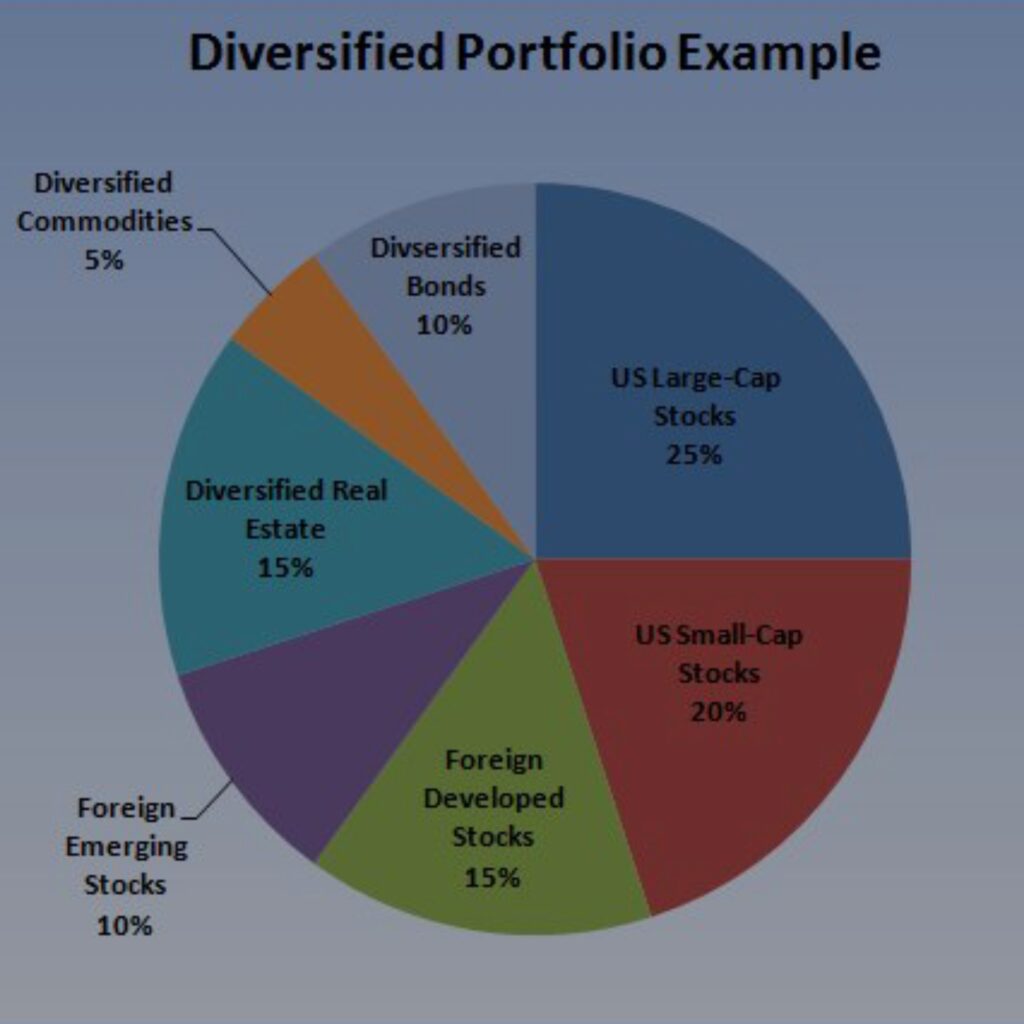

2. Diversification: “Don’t Put All Your Eggs in One Basket” Split your portfolio into “buckets”:

- 50% “Safe-ish” stuff (index funds, blue-chip stocks).

- 30% Growth (tech stocks, crypto).

- 20% Play money (NFTs, moonshots).

Your index funds can keep you afloat when the crypto market starts crashing.

3. Stop-Loss Orders: The Alarm That Stops You From Burning Dinner

You should set automatic sell orders 5–10% below your buy price.

Real life example:

A friend of mine bought Coinbase at $80. Set a stop-loss at $72. The coin dropped to $71 during a SEC lawsuit scare and it sold automatically. After two weeks, it has dropped to $63. That helped him to avoid a 21% loss.

4. The Emergency Savings Fund: My Oh Crap Cushion

Keep 6 months of expenses in a savings account that brings high yield (uninvested).

This saved me when I lost my freelance gig last year, I did not touch my investments. I avoided selling due to panic at market lows.

5. Risk-Reward Ratio: How I Weed Out Bad Trades

Only take trades where potential profit is ≥ 3x potential loss.

Simple Math

- if I risk $100 with a good stop-loss, I target $300+ gains.

- Even if 50% of trades fail, I am still in profit.

3 Mistakes to Avoid in Risk Management

1. “Just This Once” Creating Exceptions

I used 5% of my portfolio on a stock that looks sure to me. And that was against the rules I follow, It was on an AI stock, I lost $600 overnight. Now I write my rules on a sticky note: “NO MATTER WHAT.”

2. Ignoring “Black Swan” Events

I never planned for the 2023 banking crisis. My regional bank stocks tanked 40%. But later on I added 10% gold and treasury bonds to my portfolio as a safety net.

3. Copying “Gurus” Without Research

There was a time I bought a crypto “gem” a YouTuber hyped. It turns out it was a pump and dump coin.

To avoid such a scenario, I ask three questions now:

– Who will benefit if I buy this?

– What is the worst case scenario?

– Does this align with my goals?

Simple Risk Management Toolkit

Free Tools:

- TradingView Alerts: I set it to ping my phone if a stock breaks key levels.

- CoinGecko Portfolio Tracker: It shows my crypto diversification at a glance.

- Excel/Google Sheets : Never underestimate what Excel can do. This is my manual risk reward calculator.

Paid Tools That Are Worth the Cash:

- TrendSpider ($47/month): Automatically spots support/resistance levels on a chart.

- YNAB ($99/year): budgeting app that stops me from overinvesting.

Conclusion

Boring trades win the race; I mean, don’t be carried away by a fast market. Fast markets always trend with bad volatility, which you may not be experienced enough to control.

After three years, here is the truth I can lend you: the best investors are not geniuses; they are just disciplined with their trades. You can check out how I made $500/Day through Swing Trading

I have not hit a 10x moonshot, but by following these rules, I have grown my portfolio by 18% annually since 2021. More importantly, I sleep through market crashes.

Remember:

- Risk management isn’t about avoiding losses. It’s about surviving to win another day.

- Your future self will thank you for being boring now.

FAQS

How much cash should I keep vs. invest?

You can keep 6 months’ expenses in cash. Anything extra? Invest based on your risk tolerance.

What is risk management in investing?

Risk management involves strategies to minimize financial losses and protect investments from market volatility.

Is real estate a good way to diversify funds?

Yes, but REITs (like Fundrise) are easier than buying physical property.

How do I handle FOMO?

You can set a 24 hour cooling off period before buying anything hyped online. By then you would be clear on how authentic it is.

How can I improve my risk-reward ratio in trading?

Focus on trades where potential profits are at least three times the possible losses to maintain a profitable strategy.

Investor Protection: Check this for more information on risk management.